25-10-2005

Comprehensive Monitoring Report

| Contents | |

| Еxecutive summary | |

| Introduction | |

| Political Criteria | |

| Economic Criteria | |

| Commitments and Requirements arising from the Accession Negotiations | |

| Annexes | |

In its 2004 Report the Commission concluded that Bulgaria is a functioning market economy. The continuation of its current reform path should enable Bulgaria to cope with competitive pressure and market forces within the Union.

The principal purpose of this part of the Comprehensive Monitoring Report is to assess the implementation of recommendations for improvements in the areas identified in last year’s Report.

1. Economic developments

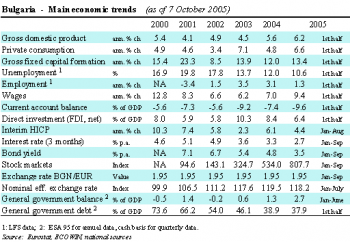

Bulgaria maintained a high degree of macroeconomic stability with strong economic growth, relatively low inflation and falling unemployment, but the external deficit remains high. Boosted by strong domestic demand and high investment, real GDP grew at 5.6% in 2004 which was the highest rate since the start of transition. GDP per capita in purchasing power standards increased to 30.8% of the EU-25 average. At 12%, gross fixed capital formation grew most strongly, whereas the highest contribution to growth came again from domestic consumption which increased by 5%. In the first half of 2005, economic performance continued to be strong with a GDP growth rate of 6.2%. Both investment and consumption growth accelerated further to 13.4% and 6.6%. Average inflation was 6.1% in 2004 and declined to 4.4% until August 2005.

In line with the strong economic expansion, the employment situation continued to improve. Employment grew by 3.1% in 2004, but the employment rate was still very low at 54.2%. In the first half of 2005, employment creation slowed down to 1.3% compared to the first half of the previous year. The unemployment rate declined further from 13.7% in 2003 to 12.0% in 2004. Wage increases remained relatively moderate in 2004 with a real wage growth rate of 0.9%, but accelerated in the first half of 2005 to 5.0%. After reaching a record high of

9.2% of GDP in 2003, the current account deficit decreased to 7.4% of GDP in 2004. However, driven by strong imports of both consumer and investment goods, the trade deficit increased from 12.5% of GDP in 2003 to 14% of GDP in 2004. In the twelve months to June 2005, the trade deficit widened further to 15.7% of GDP, contributing to a worsening of the current account deficit to 9.6% of GDP on an annualised basis. As in 2003, strong FDI inflows of 8.4% of GDP more than financed the current account deficit in 2004, while in the twelve months to June 2005 FDI inflows slowed down to an annualised 6.4% of GDP.

The currency board arrangement pegging the Bulgarian lev (BGN) to the euro continued to contribute to macroeconomic stability. Bank credits to households and non-financial enterprises expanded again at almost 50% in 2004 fuelling domestic demand and import growth. The Bulgarian National Bank (BNB) took additional measures in April 2005 to curb bank credit growth by imposing de facto ceilings on the extension of new credits. Partly in anticipation of these measures, credit growth increased again at record levels in the first quarter of 2005, but cooled down significantly to under 40% until the end of July. Fiscal policy remained stability-oriented. Due to better than expected revenues, the general government balance ended with a surplus of 1.3% of GDP in 2004 (based on EU accounting standards, ESA 95) contributing to the reduction of general government debt to below 40% of GDP in 2004.

Structural reforms have been further deepened in all areas. Reforms of product and capital markets have continued and are broadly in line with key objectives of the Lisbon agenda. Privatisation has been completed in many sectors. Good progress was made since the last Report in the sale of remaining enterprises for example in the energy sector, although not without setbacks and delays as regards for example the failed privatisation of the tobacco company or the cancellation of the privatisation process for a thermal power plant. Company restructuring in the network industries has been triggered by the privatisation of companies and the increasing liberalisation of markets. Preparations for the unbundling of the national electricity company have started with the separation of accounting systems for different units. The implementation of the national programme for the restructuring of the steel industry, adopted in March 2004, is to be completed by 2007. Progress in its implementation in the last year included the closure of some steel mills, staff reductions and further investments. In coal mining, three more coal pits were privatised during the reporting period and preparations for the privatisation of one of the two remaining state-owned mines are under way. State aid for operating mines is to be phased out completely in 2005, while the technical liquidation of closed mines continues. Prices for energy, gas and telecommunication have been fully aligned with costs. Some cross-subsidisation still exists with regard to electricity and

heating energy for households, but should be phased out in 2006. Following tariff increases for rail passenger services, the gap to full cost recovery levels has been reduced.

Market entry of new firms has been dynamic, but both market entry and exit continues to be hampered by relatively costly, complex and time consuming procedures. Financial intermediation has been further deepened both in the banking and non-banking sector. Due to the high credit growth rates, bank credits to non-financial private corporations and households have increased by almost 10 percentage points to 35% of GDP until the end of 2004. In line with credit expansion, the ratio of deposits to GDP increased by more than 10 percentage points to over 50%. Despite the high credit growth, bank performance indicators do not show any obvious deterioration in the financial situation of banks. The share of substandard and non-performing loans stood at 3.5% at the end of 2004 down from 4.2% at the end of 2003. The capital adequacy ratio declined from 22.0% at the end of 2003 to 16.1% at the end of 2004 but is still well above the legal minimum of 12%. A new regulation on the capital adequacy of banks entered into force in July 2005. The role of the non-banking sector in financial intermediation remains limited but continues to increase. Stock market capitalisation has increased as a share of GDP from 7.9% at the end of 2003 to 21.5% at the end of June 2005. The assets of pension funds have also further increased from 1.5% of GDP to 2.4% over the same period.

2. Implementation of recommendations for improvements

In its 2004 Report, the Commission noted that the current account deficit had widened substantially in 2003 and that this could, if continuing, warrant a further policy response.

After a temporary improvement in 2004, the current account deficit increased again considerably in the first half of 2005 and needs to be closely monitored. In case of a continued deterioration, additional corrective measures may become necessary. Without the possibility for active monetary and exchange rate policies within the currency board arrangement, tight fiscal and wage policies are critical for maintaining internal and external stability. Despite a better than expected export performance mainly due to favourable developments in commodity prices, the trade balance deteriorated further in 2004, because imports surged even more strongly. However, higher incomes from tourism and higher transfers together with a slightly improved income balance contributed to a decline in the current account deficit relative to GDP. In the first half of 2005, trade in goods continued to expand strongly at a rate of more than 20%, with import growth again outpacing the increase in exports. Consequently, the trade deficit and the current account deficit widened considerably in the twelve months to June 2005 to 15.7% and 9.6% of GDP, also fuelled by the recent increase in the oil price.

The continuation of prudent fiscal policies played a key role in containing the external deficit in 2004. The general government ran a budget surplus of 1.3% of GDP (ESA 95 basis) in 2004, which contributed to containing the current account deficit. A relatively tight fiscal stance was maintained in the first half of 2005, where mainly thanks to a large increase in revenues, the general government accumulated a surplus of 2.7% of the forecasted GDP on a cash basis. For the whole year 2005, the fiscal target foresees a surplus of at least 1% of GDP on a cash basis.

Real wage increases were relatively moderate in 2004, but accelerated in the first half of 2005. Real wages increased by less than 1% in 2004 and have been mostly in line with improvements in productivity over the last years. However, in the wake of a substantial 25% increase in the minimum wage in January 2005, average real wages increased by 5.0% in the first half of 2005. Maintaining overall wage restraint will, therefore, be crucial to secure competitiveness and contain further potential demand-side risks for the external balance.

Credit growth continues to be high, but the central bank has taken further steps to bring it under control. Despite some measures taken by the BNB in the second half of 2004, bank credits continued to increase at a rate of close to 50% for the second consecutive year. Additional measures to curb the credit boom entered into force in April 2005, effectively imposing ceilings on the further extension of credits by raising the minimum reserve requirement to prohibitive levels if the average growth rate of credits exceeds 5% for a three-month period, 12.5% for a six-month period, 17.5% for a nine-month period and 23% for a twelve-month period. Partly in anticipation of these measures, growth of credits to non-financial private corporations and households increased again massively by more than 70% year-on-year by the end of March 2005, but has since come down to below 40% by the end of July.

In its 2004 Report, the Commission noted that the business environment, in particular the efficiency of the administrative and judicial system as well as regulatory procedures, should be further improved to increase Bulgaria’s attractiveness for investment.

Efforts to improve the business environment have continued, but many obstacles remain and some reforms have been delayed or still need to be fully implemented. Despite some improvements, business surveys indicate that procedures for market entry and exit as well as contract enforcement still tend to be very time-consuming, costly and complex. Some first steps have been taken to streamline business registration with the adoption of the long-awaited Law on the Bulstat registry on 27 April 2005 and the ensuing adoption of a government strategy for the actual establishment of a central register of legal entities and of an electronic register of Bulgaria. The aim is to unify the registration of businesses with the Registry Agency under the Ministry of Justice, to turn business registration from a court procedure into a purely administrative procedure, and to introduce a single Bulstat number for tax and social security purposes. These measures will be important for making business registration simpler and more transparent, but still need to be fully implemented.

The Tax and Social Security Procedural Code which will provide for the integration of the collection of taxes and social security contributions and thereby lay the basis for the functioning of the National Revenue Agency also still needs to be adopted in this context. The project for the modernisation of the land registration system has encountered delays, although some progress in the functioning of the Cadastre Agency has been made especially at regional level. Hardly any progress has been made to improve the efficiency of bankruptcy procedures. Moreover, further planned amendments to the insolvency legislation are still only in the process of preparation.

Further efforts have been made to improve the functioning of the administration and to streamline existing regulation in line with the Law on the Restriction of Administrative Regulation and Control on Business Activity of December 2003. The review of existing licensing, registration and authorisation regimes with a view to alleviate or lift these regulations has continued, as well as the introduction of one-stop shops. A majority of administrative units have tried to strengthen their service-orientation by adopting clients’ charters and by increasing the availability of e-government services. The Law on Investment Promotion was also amended in April 2005 lowering the thresholds for potential investors to receive preferential treatment. However, the extent to which these measures lead to tangible improvements in the conditions for doing business is not always clear. A more systematic and comprehensive assessment of the business impact of existing as well as new legislation beyond the review of regulatory regimes mentioned above, including regulations at local level, would be important to further improve the business environment especially for SMEs. While the Law on the Restriction of Administrative Regulation envisages the introduction of regulatory impact assessments, this needs to be implemented more systematically. The same holds for the introduction of ‘silent consent’ as a general principle in administrative procedures.

Some steps were taken to improve the functioning of the judicial system, but major challenges remain. Judicial reform made some progress (see also the section on political issues) but improving the functioning of the judicial system remains crucial for providing a transparent, stable and reliable legal framework for doing business and enforcing property rights. Delays have occurred in the adoption of the Administrative Procedure Code and the revision of the Civil Procedure Code which will be important for speeding up legal procedures, facilitating the review of administrative acts and providing greater clarity and legal certainty. A Law on Mediation as an alternative out-of-court procedure for conflict resolution entered into force in December 2004. The enforcement of judgements by private bailiffs has in principle been facilitated by a law adopted in May 2005. Both measures still need to be fully implemented, but should help improving the functioning of the judicial system and in particular the conditions for contract enforcement.

In its 2004 Report, the Commission noted that in spite of significant achievements, privatisation still needed to be completed.

Further good progress was made in this area, although some delays occurred. The privatisation process is well advanced with the privatisation of almost 90% of all assets due to be privatised in the medium-term having been achieved by March 2005. In many sectors privatisation has already been completed. For 2005, the privatisation of another 46 majority-owned enterprises, 20 separate parts and 167 minority stakes is foreseen according to the Action Plan of the Privatisation Agency. Until June 2005, 37 deals have been completed involving 29 majority packages and 8 parts of companies. In addition, 156 minority packages have been sold, mostly over the stock exchange.

Good progress was made on the privatisation of companies in the energy sector. Majority stakes in the seven regional electricity distribution companies were successfully privatised at the end of 2004. The winners in the bids for the thermal power plants in Varna, Rousse and Bobov Dol were announced in May 2005. However, the final decision on the sale of the power plants in Rousse and Varna has been postponed several times because of negotiations on certain details of the regulatory framework and a negative verdict by the competition agency on the sale of the two plants to the same bidder; the sale of the power plant in Bobov Dol was cancelled because the offer of the winning bidder was considered too low. Three hydro-power plants were sold in May and preparations for the sale of a further seven plants are under way. The privatisation of the former telecommunication monopoly was completed when the remaining 35% stake in the Bulgarian Telecommunication Company was sold on the Bulgarian stock exchange in January 2005. The winning bidders for the remaining 70% stake in the Bulgarian River Shipping Company and the Boyana film studios were chosen in June 2005. However, both deals are currently blocked because of judicial reviews following appeals by the losing bidders. The privatisation of Bulgartabac failed for a third time when the sole remaining bidder for the holding’s cigarette manufacturing companies withdrew its offer in February 2005. The privatisation plans for Bulgaria Air and the Maritime Fleet have not been endorsed by Parliament and a revision of the privatisation strategies for the two companies was announced in September 2005. 25 Bulgarian commercial banks jointly acquired a majority stake in the card operator BORICA in May 2005. Preparations for the sale of a number of arms producers (Teraton, Kintez and VMZ Sopot) have started. The privatisation plan for VMZ Sobot military plant was approved by the Council of Ministers in June 2005.

In its 2004 Report, the Commission noted that the actual restructuring and liberalisation of the network industries needed to progress further in order to enhance competition and efficiency.

Good progress has been made in the liberalisation and restructuring of the energy sector. Privatisation in the energy sector has advanced substantially with the sale of the regional electricity distribution companies at the end of 2004, several district heating companies in 2004 and 2005 and several hydro-power plants and coal mines. The liberalisation of the electricity sector continued with the lowering of the threshold for direct contracting between power generators and large industrial consumers. By August 2005, the liberalised market segment included eleven licensed buyers and five licensed producers and covered approximately 12.5% of the overall consumption. This process is set to continue gradually until full liberalisation will be achieved in mid-2007. Alignment of electricity prices with cost-recovery levels had already been achieved in several steps until mid-2004 although a certain cross-subsidisation of household consumption of electricity and heating energy continues to exist. In line with the successful restructuring of the energy sector, state aid has almost entirely been phased out. Restructuring of the national electricity company still needs to be completed with the unbundling of activities due to take place before accession. In line with the electricity sector, liberalisation of the gas market has also started in 2004 and covers in principle 80% of the whole market. However, while growing, the gas market remains relatively small and the actual degree of opening is only about 6.6% of total consumption. Several investment projects to upgrade existing facilities in the energy sector were being implemented in the reporting period but further investments will be needed in the coming years.

Good progress has been made in the liberalisation and restructuring of the transport sector, but the process needs to continue. Steady progress in the restructuring of the railway sector through the closure of loss-making lines and services as well as staff reductions has improved the productivity and financial position of the national rail operator. Following a decision by the Council of Ministers in November 2004, further lines are due to be closed in 2005 and 2006. Tariff increases have raised cost-recovery ratios and government transfers have been put on a more transparent and stable basis through the conclusion of a public service contract which will be reviewed regularly. The basis for more competition has been laid with the licensing of a second private, national freight operator in April 2005. While the modernisation of the network and the rolling stock has started, further efforts are needed to reduce costs and to bring tariffs in line with costs. Concessions for private operators were granted for the airports in Varna and Bourgas where the deals have, however, been halted following a legal appeal by some of the losing bidders. Concessions were also granted for one sea port and one river port. Overall, more than 20 river and sea ports are due to be offered for concession. A concession agreement was signed for the construction and operation of Trakia motorway in March 2005. This deal is currently subject to a judicial review, after the Deputy Prosecutor General challenged the award of the concession in June 2005 before the Supreme Administrative Court because it did not involve an open tender procedure. While the involvement of private investors through concession agreements should aid the much-needed modernisation of the national transport infrastructure, ensuring the transparency of the process will be crucial for maintaining the confidence of potential future investors and for avoiding lengthy legal conflicts.

The liberalisation of the telecommunication sector continued, but attention needs to be given to effectively increase competition.

Regarding telecommunications, the privatisation of the former monopoly was completed with the sale of the remaining state-owned shares on the Bulgarian stock exchange in January 2005. Six additional licenses for fixed-line services were granted in the first half of 2005, bringing the total number of licenses to 16. Eight inter-connection agreements have so far been signed between new operators and the network provider. Actual competition in the market for fixed-line telephony is, however, still limited due to the small market share of new entrants. While competition for mobile phone services should increase with the launch of a third GSM operator, which was delayed until the end of the year, prices for mobile phone calls are still relatively high. Three UMTS licenses were granted in April 2005, but services are not expected to start before mid-2006. The liberalisation and restructuring of the telecommunication sector is well advanced, but ensuring non-discriminatory network access for cable, internet and fixed-line service providers and preventing the abuse of market power by incumbents will be crucial for improving competition. This implies an increasingly important role for the regulators, who have already adopted a number of important decisions in this respect in the first half of 2005.

In its 2004 Report, the Commission noted that the ongoing reduction in unemployment should be further supported by reducing rigidities in labour market regulation.

While the situation in the labour market has continued to improve, only limited progress was made in making labour markets more flexible. In March 2005, an amendment to the Labour Code facilitated the extension of normal weekly working hours to some extent. However, rules on working time still remain relatively rigid and provide little room for introducing more flexible working time arrangements, including for example through collective agreements. Measures to promote the employment of disadvantaged groups in the labour market were accompanied by a certain tightening of eligibility criteria for unemployment benefits in April 2005, which together with appropriate control and activation should increase the incentives to take up work. A reform in the unemployment insurance system, shifting responsibilities for the administration and control of contributions and benefits to the National Social Security Institute should help to reduce the size of the informal sector. The transposition of EU legislation on fixed-term work which puts fixed-term workers on an equal footing with regular employees as regards employment and working conditions has not been used as an opportunity to alleviate existing restrictions on the use of fixed-term contracts. Job mobility continues to be hampered by the portability of seniority-based bonuses. Talks between the social partners on integrating these bonuses into the normal pay scale as well as dialogue on more comprehensive measures to improve labour market flexibility have not led to any results so far. Active labour market programmes aim at the integration of disadvantaged groups in the labour market and at improving the employability of the workforce by providing education and training. A regular evaluation of these programmes is important to ensure their effectiveness. The functioning of the labour market also continues to be hampered by low regional mobility of the workforce and skills mismatches, due to persistent labour market rigidities and an education and training system, which is ill-adapted to labour market needs and does not adequately provide for continuous updating of skills through life-long learning.

3. General evaluation

As regards the economic criteria for accession, Bulgaria continues to be a functioning market economy. The continuation of the current pace of its reform path should enable Bulgaria to cope with competitive pressure and market forces within the Union. Bulgaria has broadly maintained macroeconomic stability, even if external deficits have further risen. It continued implementing its structural reform programme, albeit not equally vigorously in all fields.

Progress has been made in most areas where improvements were suggested in last year’s report, but a number of challenges remain. After narrowing in 2004, the trade and current account deficit widened considerably again in the first half of 2005. Further measures have been taken to curb bank credit growth, but the continuation of prudent fiscal policy and moderate wage increases remains critical to containing potential risks for the external balance and the situation needs to be closely monitored. Further reforms are needed to improve the business environment, and in particular the functioning of the administrative and judicial system. The streamlining of business registration has started but remains to be completed. While already well advanced, the momentum in completing the privatisation programme should be maintained. Little progress has been made in improving labour market flexibility, which, together with a comprehensive reform of the education system, would be crucial for dealing with skills mismatches and improving the adaptability of the Bulgarian economy.

The principal purpose of this part of the Comprehensive Monitoring Report is to assess the implementation of recommendations for improvements in the areas identified in last year’s Report.

1. Economic developments

Bulgaria maintained a high degree of macroeconomic stability with strong economic growth, relatively low inflation and falling unemployment, but the external deficit remains high. Boosted by strong domestic demand and high investment, real GDP grew at 5.6% in 2004 which was the highest rate since the start of transition. GDP per capita in purchasing power standards increased to 30.8% of the EU-25 average. At 12%, gross fixed capital formation grew most strongly, whereas the highest contribution to growth came again from domestic consumption which increased by 5%. In the first half of 2005, economic performance continued to be strong with a GDP growth rate of 6.2%. Both investment and consumption growth accelerated further to 13.4% and 6.6%. Average inflation was 6.1% in 2004 and declined to 4.4% until August 2005.

In line with the strong economic expansion, the employment situation continued to improve. Employment grew by 3.1% in 2004, but the employment rate was still very low at 54.2%. In the first half of 2005, employment creation slowed down to 1.3% compared to the first half of the previous year. The unemployment rate declined further from 13.7% in 2003 to 12.0% in 2004. Wage increases remained relatively moderate in 2004 with a real wage growth rate of 0.9%, but accelerated in the first half of 2005 to 5.0%. After reaching a record high of

|

|

голям размер голям размер |

The currency board arrangement pegging the Bulgarian lev (BGN) to the euro continued to contribute to macroeconomic stability. Bank credits to households and non-financial enterprises expanded again at almost 50% in 2004 fuelling domestic demand and import growth. The Bulgarian National Bank (BNB) took additional measures in April 2005 to curb bank credit growth by imposing de facto ceilings on the extension of new credits. Partly in anticipation of these measures, credit growth increased again at record levels in the first quarter of 2005, but cooled down significantly to under 40% until the end of July. Fiscal policy remained stability-oriented. Due to better than expected revenues, the general government balance ended with a surplus of 1.3% of GDP in 2004 (based on EU accounting standards, ESA 95) contributing to the reduction of general government debt to below 40% of GDP in 2004.

Structural reforms have been further deepened in all areas. Reforms of product and capital markets have continued and are broadly in line with key objectives of the Lisbon agenda. Privatisation has been completed in many sectors. Good progress was made since the last Report in the sale of remaining enterprises for example in the energy sector, although not without setbacks and delays as regards for example the failed privatisation of the tobacco company or the cancellation of the privatisation process for a thermal power plant. Company restructuring in the network industries has been triggered by the privatisation of companies and the increasing liberalisation of markets. Preparations for the unbundling of the national electricity company have started with the separation of accounting systems for different units. The implementation of the national programme for the restructuring of the steel industry, adopted in March 2004, is to be completed by 2007. Progress in its implementation in the last year included the closure of some steel mills, staff reductions and further investments. In coal mining, three more coal pits were privatised during the reporting period and preparations for the privatisation of one of the two remaining state-owned mines are under way. State aid for operating mines is to be phased out completely in 2005, while the technical liquidation of closed mines continues. Prices for energy, gas and telecommunication have been fully aligned with costs. Some cross-subsidisation still exists with regard to electricity and

|

|

голям размер голям размер |

Market entry of new firms has been dynamic, but both market entry and exit continues to be hampered by relatively costly, complex and time consuming procedures. Financial intermediation has been further deepened both in the banking and non-banking sector. Due to the high credit growth rates, bank credits to non-financial private corporations and households have increased by almost 10 percentage points to 35% of GDP until the end of 2004. In line with credit expansion, the ratio of deposits to GDP increased by more than 10 percentage points to over 50%. Despite the high credit growth, bank performance indicators do not show any obvious deterioration in the financial situation of banks. The share of substandard and non-performing loans stood at 3.5% at the end of 2004 down from 4.2% at the end of 2003. The capital adequacy ratio declined from 22.0% at the end of 2003 to 16.1% at the end of 2004 but is still well above the legal minimum of 12%. A new regulation on the capital adequacy of banks entered into force in July 2005. The role of the non-banking sector in financial intermediation remains limited but continues to increase. Stock market capitalisation has increased as a share of GDP from 7.9% at the end of 2003 to 21.5% at the end of June 2005. The assets of pension funds have also further increased from 1.5% of GDP to 2.4% over the same period.

2. Implementation of recommendations for improvements

In its 2004 Report, the Commission noted that the current account deficit had widened substantially in 2003 and that this could, if continuing, warrant a further policy response.

After a temporary improvement in 2004, the current account deficit increased again considerably in the first half of 2005 and needs to be closely monitored. In case of a continued deterioration, additional corrective measures may become necessary. Without the possibility for active monetary and exchange rate policies within the currency board arrangement, tight fiscal and wage policies are critical for maintaining internal and external stability. Despite a better than expected export performance mainly due to favourable developments in commodity prices, the trade balance deteriorated further in 2004, because imports surged even more strongly. However, higher incomes from tourism and higher transfers together with a slightly improved income balance contributed to a decline in the current account deficit relative to GDP. In the first half of 2005, trade in goods continued to expand strongly at a rate of more than 20%, with import growth again outpacing the increase in exports. Consequently, the trade deficit and the current account deficit widened considerably in the twelve months to June 2005 to 15.7% and 9.6% of GDP, also fuelled by the recent increase in the oil price.

The continuation of prudent fiscal policies played a key role in containing the external deficit in 2004. The general government ran a budget surplus of 1.3% of GDP (ESA 95 basis) in 2004, which contributed to containing the current account deficit. A relatively tight fiscal stance was maintained in the first half of 2005, where mainly thanks to a large increase in revenues, the general government accumulated a surplus of 2.7% of the forecasted GDP on a cash basis. For the whole year 2005, the fiscal target foresees a surplus of at least 1% of GDP on a cash basis.

Real wage increases were relatively moderate in 2004, but accelerated in the first half of 2005. Real wages increased by less than 1% in 2004 and have been mostly in line with improvements in productivity over the last years. However, in the wake of a substantial 25% increase in the minimum wage in January 2005, average real wages increased by 5.0% in the first half of 2005. Maintaining overall wage restraint will, therefore, be crucial to secure competitiveness and contain further potential demand-side risks for the external balance.

Credit growth continues to be high, but the central bank has taken further steps to bring it under control. Despite some measures taken by the BNB in the second half of 2004, bank credits continued to increase at a rate of close to 50% for the second consecutive year. Additional measures to curb the credit boom entered into force in April 2005, effectively imposing ceilings on the further extension of credits by raising the minimum reserve requirement to prohibitive levels if the average growth rate of credits exceeds 5% for a three-month period, 12.5% for a six-month period, 17.5% for a nine-month period and 23% for a twelve-month period. Partly in anticipation of these measures, growth of credits to non-financial private corporations and households increased again massively by more than 70% year-on-year by the end of March 2005, but has since come down to below 40% by the end of July.

In its 2004 Report, the Commission noted that the business environment, in particular the efficiency of the administrative and judicial system as well as regulatory procedures, should be further improved to increase Bulgaria’s attractiveness for investment.

Efforts to improve the business environment have continued, but many obstacles remain and some reforms have been delayed or still need to be fully implemented. Despite some improvements, business surveys indicate that procedures for market entry and exit as well as contract enforcement still tend to be very time-consuming, costly and complex. Some first steps have been taken to streamline business registration with the adoption of the long-awaited Law on the Bulstat registry on 27 April 2005 and the ensuing adoption of a government strategy for the actual establishment of a central register of legal entities and of an electronic register of Bulgaria. The aim is to unify the registration of businesses with the Registry Agency under the Ministry of Justice, to turn business registration from a court procedure into a purely administrative procedure, and to introduce a single Bulstat number for tax and social security purposes. These measures will be important for making business registration simpler and more transparent, but still need to be fully implemented.

The Tax and Social Security Procedural Code which will provide for the integration of the collection of taxes and social security contributions and thereby lay the basis for the functioning of the National Revenue Agency also still needs to be adopted in this context. The project for the modernisation of the land registration system has encountered delays, although some progress in the functioning of the Cadastre Agency has been made especially at regional level. Hardly any progress has been made to improve the efficiency of bankruptcy procedures. Moreover, further planned amendments to the insolvency legislation are still only in the process of preparation.

Further efforts have been made to improve the functioning of the administration and to streamline existing regulation in line with the Law on the Restriction of Administrative Regulation and Control on Business Activity of December 2003. The review of existing licensing, registration and authorisation regimes with a view to alleviate or lift these regulations has continued, as well as the introduction of one-stop shops. A majority of administrative units have tried to strengthen their service-orientation by adopting clients’ charters and by increasing the availability of e-government services. The Law on Investment Promotion was also amended in April 2005 lowering the thresholds for potential investors to receive preferential treatment. However, the extent to which these measures lead to tangible improvements in the conditions for doing business is not always clear. A more systematic and comprehensive assessment of the business impact of existing as well as new legislation beyond the review of regulatory regimes mentioned above, including regulations at local level, would be important to further improve the business environment especially for SMEs. While the Law on the Restriction of Administrative Regulation envisages the introduction of regulatory impact assessments, this needs to be implemented more systematically. The same holds for the introduction of ‘silent consent’ as a general principle in administrative procedures.

Some steps were taken to improve the functioning of the judicial system, but major challenges remain. Judicial reform made some progress (see also the section on political issues) but improving the functioning of the judicial system remains crucial for providing a transparent, stable and reliable legal framework for doing business and enforcing property rights. Delays have occurred in the adoption of the Administrative Procedure Code and the revision of the Civil Procedure Code which will be important for speeding up legal procedures, facilitating the review of administrative acts and providing greater clarity and legal certainty. A Law on Mediation as an alternative out-of-court procedure for conflict resolution entered into force in December 2004. The enforcement of judgements by private bailiffs has in principle been facilitated by a law adopted in May 2005. Both measures still need to be fully implemented, but should help improving the functioning of the judicial system and in particular the conditions for contract enforcement.

In its 2004 Report, the Commission noted that in spite of significant achievements, privatisation still needed to be completed.

Further good progress was made in this area, although some delays occurred. The privatisation process is well advanced with the privatisation of almost 90% of all assets due to be privatised in the medium-term having been achieved by March 2005. In many sectors privatisation has already been completed. For 2005, the privatisation of another 46 majority-owned enterprises, 20 separate parts and 167 minority stakes is foreseen according to the Action Plan of the Privatisation Agency. Until June 2005, 37 deals have been completed involving 29 majority packages and 8 parts of companies. In addition, 156 minority packages have been sold, mostly over the stock exchange.

Good progress was made on the privatisation of companies in the energy sector. Majority stakes in the seven regional electricity distribution companies were successfully privatised at the end of 2004. The winners in the bids for the thermal power plants in Varna, Rousse and Bobov Dol were announced in May 2005. However, the final decision on the sale of the power plants in Rousse and Varna has been postponed several times because of negotiations on certain details of the regulatory framework and a negative verdict by the competition agency on the sale of the two plants to the same bidder; the sale of the power plant in Bobov Dol was cancelled because the offer of the winning bidder was considered too low. Three hydro-power plants were sold in May and preparations for the sale of a further seven plants are under way. The privatisation of the former telecommunication monopoly was completed when the remaining 35% stake in the Bulgarian Telecommunication Company was sold on the Bulgarian stock exchange in January 2005. The winning bidders for the remaining 70% stake in the Bulgarian River Shipping Company and the Boyana film studios were chosen in June 2005. However, both deals are currently blocked because of judicial reviews following appeals by the losing bidders. The privatisation of Bulgartabac failed for a third time when the sole remaining bidder for the holding’s cigarette manufacturing companies withdrew its offer in February 2005. The privatisation plans for Bulgaria Air and the Maritime Fleet have not been endorsed by Parliament and a revision of the privatisation strategies for the two companies was announced in September 2005. 25 Bulgarian commercial banks jointly acquired a majority stake in the card operator BORICA in May 2005. Preparations for the sale of a number of arms producers (Teraton, Kintez and VMZ Sopot) have started. The privatisation plan for VMZ Sobot military plant was approved by the Council of Ministers in June 2005.

In its 2004 Report, the Commission noted that the actual restructuring and liberalisation of the network industries needed to progress further in order to enhance competition and efficiency.

Good progress has been made in the liberalisation and restructuring of the energy sector. Privatisation in the energy sector has advanced substantially with the sale of the regional electricity distribution companies at the end of 2004, several district heating companies in 2004 and 2005 and several hydro-power plants and coal mines. The liberalisation of the electricity sector continued with the lowering of the threshold for direct contracting between power generators and large industrial consumers. By August 2005, the liberalised market segment included eleven licensed buyers and five licensed producers and covered approximately 12.5% of the overall consumption. This process is set to continue gradually until full liberalisation will be achieved in mid-2007. Alignment of electricity prices with cost-recovery levels had already been achieved in several steps until mid-2004 although a certain cross-subsidisation of household consumption of electricity and heating energy continues to exist. In line with the successful restructuring of the energy sector, state aid has almost entirely been phased out. Restructuring of the national electricity company still needs to be completed with the unbundling of activities due to take place before accession. In line with the electricity sector, liberalisation of the gas market has also started in 2004 and covers in principle 80% of the whole market. However, while growing, the gas market remains relatively small and the actual degree of opening is only about 6.6% of total consumption. Several investment projects to upgrade existing facilities in the energy sector were being implemented in the reporting period but further investments will be needed in the coming years.

Good progress has been made in the liberalisation and restructuring of the transport sector, but the process needs to continue. Steady progress in the restructuring of the railway sector through the closure of loss-making lines and services as well as staff reductions has improved the productivity and financial position of the national rail operator. Following a decision by the Council of Ministers in November 2004, further lines are due to be closed in 2005 and 2006. Tariff increases have raised cost-recovery ratios and government transfers have been put on a more transparent and stable basis through the conclusion of a public service contract which will be reviewed regularly. The basis for more competition has been laid with the licensing of a second private, national freight operator in April 2005. While the modernisation of the network and the rolling stock has started, further efforts are needed to reduce costs and to bring tariffs in line with costs. Concessions for private operators were granted for the airports in Varna and Bourgas where the deals have, however, been halted following a legal appeal by some of the losing bidders. Concessions were also granted for one sea port and one river port. Overall, more than 20 river and sea ports are due to be offered for concession. A concession agreement was signed for the construction and operation of Trakia motorway in March 2005. This deal is currently subject to a judicial review, after the Deputy Prosecutor General challenged the award of the concession in June 2005 before the Supreme Administrative Court because it did not involve an open tender procedure. While the involvement of private investors through concession agreements should aid the much-needed modernisation of the national transport infrastructure, ensuring the transparency of the process will be crucial for maintaining the confidence of potential future investors and for avoiding lengthy legal conflicts.

The liberalisation of the telecommunication sector continued, but attention needs to be given to effectively increase competition.

Regarding telecommunications, the privatisation of the former monopoly was completed with the sale of the remaining state-owned shares on the Bulgarian stock exchange in January 2005. Six additional licenses for fixed-line services were granted in the first half of 2005, bringing the total number of licenses to 16. Eight inter-connection agreements have so far been signed between new operators and the network provider. Actual competition in the market for fixed-line telephony is, however, still limited due to the small market share of new entrants. While competition for mobile phone services should increase with the launch of a third GSM operator, which was delayed until the end of the year, prices for mobile phone calls are still relatively high. Three UMTS licenses were granted in April 2005, but services are not expected to start before mid-2006. The liberalisation and restructuring of the telecommunication sector is well advanced, but ensuring non-discriminatory network access for cable, internet and fixed-line service providers and preventing the abuse of market power by incumbents will be crucial for improving competition. This implies an increasingly important role for the regulators, who have already adopted a number of important decisions in this respect in the first half of 2005.

In its 2004 Report, the Commission noted that the ongoing reduction in unemployment should be further supported by reducing rigidities in labour market regulation.

While the situation in the labour market has continued to improve, only limited progress was made in making labour markets more flexible. In March 2005, an amendment to the Labour Code facilitated the extension of normal weekly working hours to some extent. However, rules on working time still remain relatively rigid and provide little room for introducing more flexible working time arrangements, including for example through collective agreements. Measures to promote the employment of disadvantaged groups in the labour market were accompanied by a certain tightening of eligibility criteria for unemployment benefits in April 2005, which together with appropriate control and activation should increase the incentives to take up work. A reform in the unemployment insurance system, shifting responsibilities for the administration and control of contributions and benefits to the National Social Security Institute should help to reduce the size of the informal sector. The transposition of EU legislation on fixed-term work which puts fixed-term workers on an equal footing with regular employees as regards employment and working conditions has not been used as an opportunity to alleviate existing restrictions on the use of fixed-term contracts. Job mobility continues to be hampered by the portability of seniority-based bonuses. Talks between the social partners on integrating these bonuses into the normal pay scale as well as dialogue on more comprehensive measures to improve labour market flexibility have not led to any results so far. Active labour market programmes aim at the integration of disadvantaged groups in the labour market and at improving the employability of the workforce by providing education and training. A regular evaluation of these programmes is important to ensure their effectiveness. The functioning of the labour market also continues to be hampered by low regional mobility of the workforce and skills mismatches, due to persistent labour market rigidities and an education and training system, which is ill-adapted to labour market needs and does not adequately provide for continuous updating of skills through life-long learning.

3. General evaluation

As regards the economic criteria for accession, Bulgaria continues to be a functioning market economy. The continuation of the current pace of its reform path should enable Bulgaria to cope with competitive pressure and market forces within the Union. Bulgaria has broadly maintained macroeconomic stability, even if external deficits have further risen. It continued implementing its structural reform programme, albeit not equally vigorously in all fields.

Progress has been made in most areas where improvements were suggested in last year’s report, but a number of challenges remain. After narrowing in 2004, the trade and current account deficit widened considerably again in the first half of 2005. Further measures have been taken to curb bank credit growth, but the continuation of prudent fiscal policy and moderate wage increases remains critical to containing potential risks for the external balance and the situation needs to be closely monitored. Further reforms are needed to improve the business environment, and in particular the functioning of the administrative and judicial system. The streamlining of business registration has started but remains to be completed. While already well advanced, the momentum in completing the privatisation programme should be maintained. Little progress has been made in improving labour market flexibility, which, together with a comprehensive reform of the education system, would be crucial for dealing with skills mismatches and improving the adaptability of the Bulgarian economy.

Svejo

Svejo Twitter

Twitter Link4e

Link4e Pipe

Pipe Web-bg

Web-bg Bghot

Bghot Lubimi

Lubimi Novinitednes

Novinitednes Ping

Ping Facebook

Facebook Myspace

Myspace Mix

Mix Del.ico.us

Del.ico.us Reddit

Reddit Digg

Digg Stumbleupon

Stumbleupon Myweb Yahoo

Myweb Yahoo Google Bookmarks

Google Bookmarks Google Buzz

Google Buzz